Contextual Solutions Blog

This page is dedicated to our original and curated content about FinTech, digital banking, LegalTech, and innovation.

DXC & Ripple: A Catalyst for Blockchain Integration in Global Finance

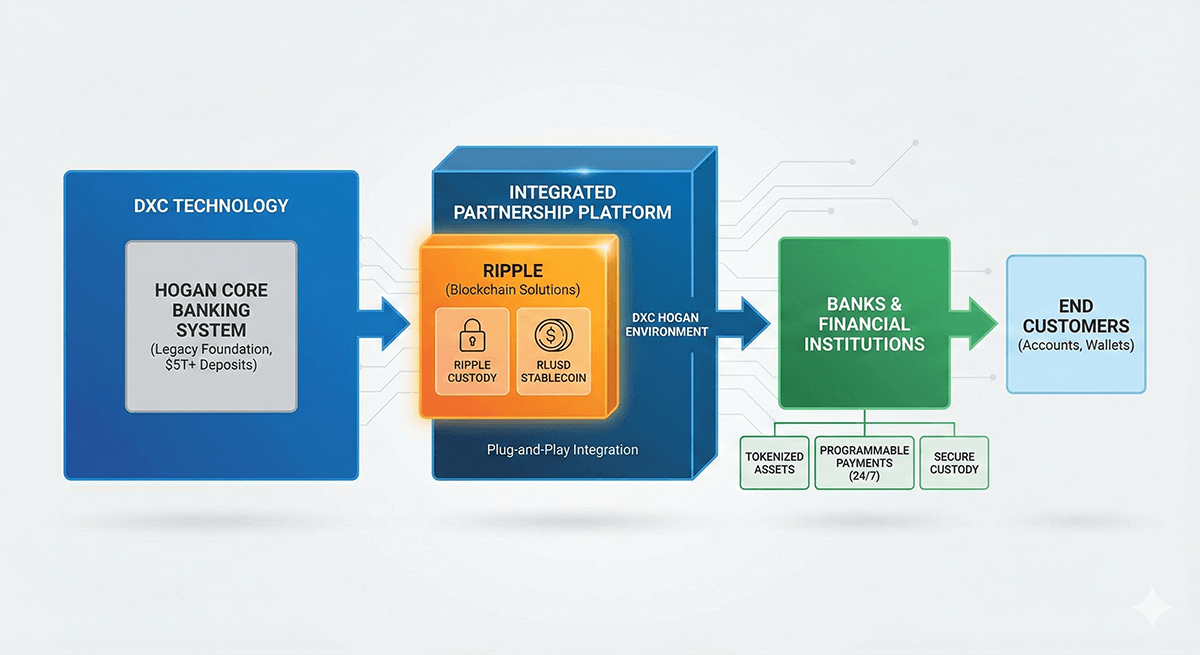

In a game-changing move for fintech, DXC Technology's January 2026 partnership with Ripple embeds digital asset custody and RLUSD stablecoins into its Hogan core banking system, enabling seamless tokenized services for banks. This aligns with Europe's MiCA regulations, accelerating blockchain adoption amid projections of a $10 trillion tokenized assets market by 2030. Complementing this is Revolut's Polygon integration, offering zero-fee stablecoin remittances and crypto staking to millions, highlighting consumer-facing innovation. Together, these alliances bridge traditional finance and DeFi, promising cross-border efficiency, new revenues, and competitive edges—essential insights for finance executives navigating a tokenized future.

EU Inc: Von der Leyen's 2026 Plan to Boost European Tech Innovation and Startups

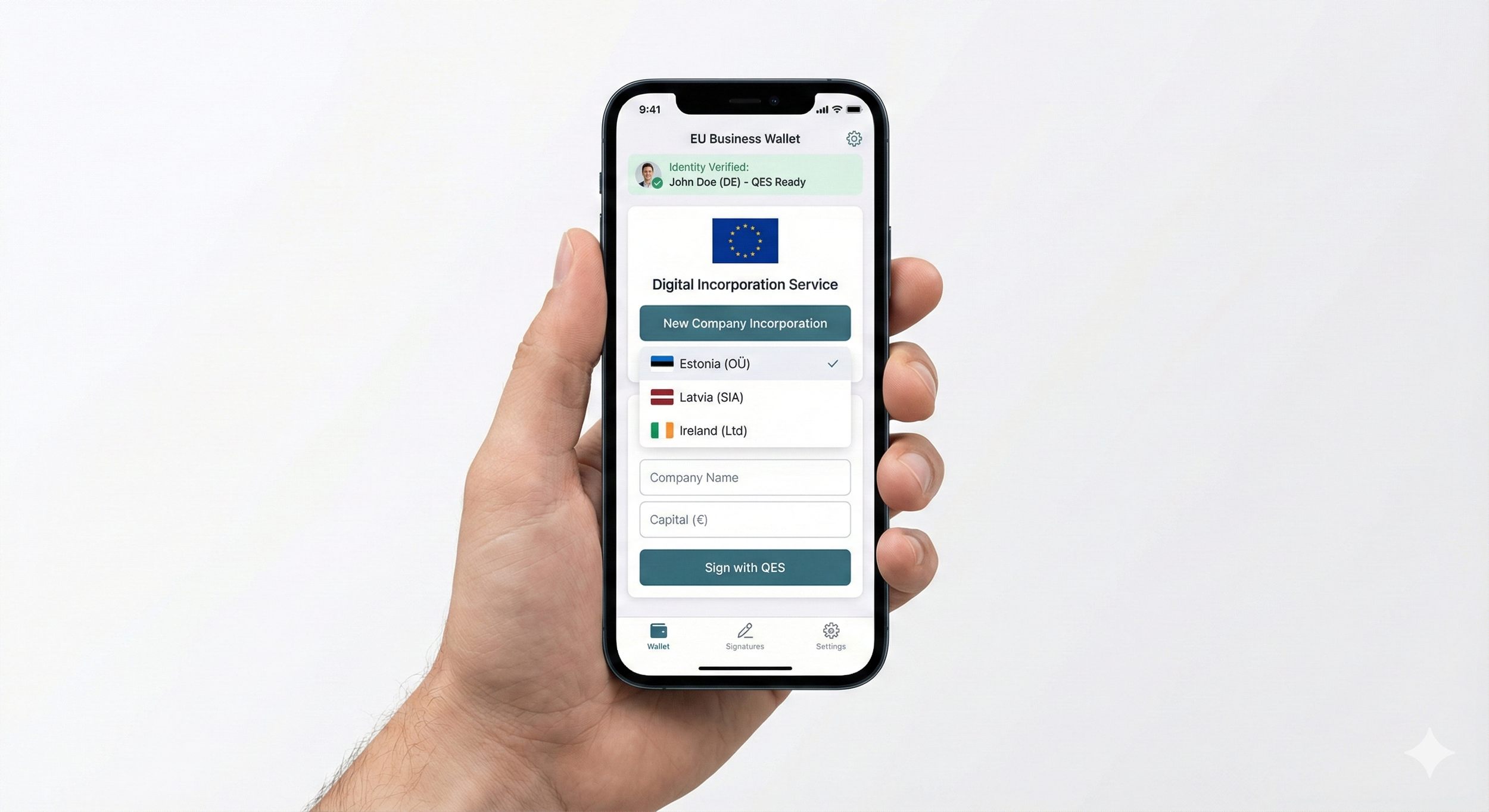

Ursula von der Leyen's announcement of EU Inc at the 2026 World Economic Forum in Davos represents a pivotal shift for European business and technology. This "28th regime" aims to create a unified pan-European company structure, allowing startups to incorporate online in 48 hours and operate seamlessly across 27 member states. By reducing regulatory fragmentation, EU Inc could enhance tech innovation in AI, defense, and deep tech sectors, fostering European champions amid global competition. However, challenges like implementation details and balancing worker protections remain. This essay delves into the announcement's implications, benefits, and potential hurdles for Europe's tech ecosystem.

Bridging Global Innovation and Local Trust: Our Partnership with SOFTEL

Contextual Solutions is proud to announce a strategic partnership with global heavyweight SOFTEL. We have been mandated to lead their expansion into the German market, bridging the gap between global innovation and local compliance. Together, we are bringing enterprise-grade Cloud Contact Centers (CCaaS) and AI integration to the DACH region, ensuring strict adherence to data sovereignty, DORA, and GDPR.

Why Europe’s AI Future Lies in the Edge, Not the Cloud

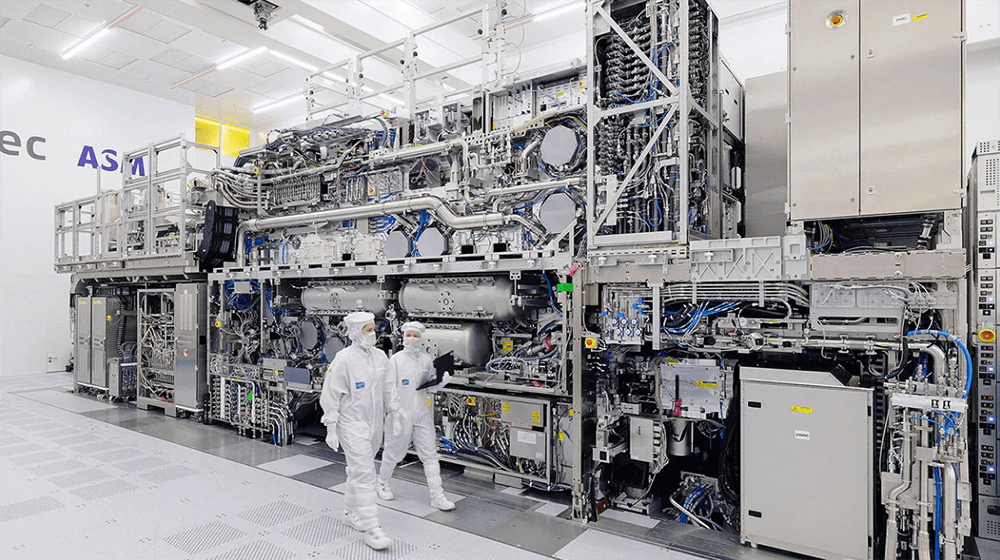

The narrative that Europe has "lost" the AI race is wrong. While the US burns gigawatts to train massive models, Europe is specializing in inference—the efficient, on-device application of AI in the real world. From Mistral’s small models to Axelera’s edge chips, here is how thermodynamics and GDPR are shaping a new, profitable path for European tech.

The Munich Flip: How Old Money Could Build Europe’s Tech Future

For a decade, European tech was synonymous with Berlin software and American VC money. That era is ending. A new regime is emerging in Munich, driven not by venture funds, but by the "Mittelstand Liquidity Event." German industrial dynasties are unlocking trillions in private wealth to directly fund the deep tech hardware that will save their legacy. Here is why the "Death of the GP" and the rise of the Munich ecosystem marks the beginning of Europe's "Grey Tech" Golden Age.

Prediction: The 28th Regime Arrives in 2026, As a Wallet

For twenty years, Europe chased the dream of a unified "EU Company" structure. It never happened. Now, a silent revolution is replacing politics with technology. The new European Business Wallet allows founders to bypass local notaries and incorporate anywhere instantly—making the location of your company as fluid as your software. Here is why the "28th Regime" is arriving in 2026 not as a statute, but as an app.

European Fintech Fundraising & VC: 2025-2026

The "Fintech Winter" didn't end with a thaw; it ended with a renovation. In 2025, European fintech saw a 15% spike in AI down rounds, a 42% surge in late-stage funding, and massive consolidation deals like Global Payments and Worldpay. We analyze the shift from exuberance to industrial maturity and what lies ahead for 2026.

European Fintech Private Market Outlook 2026: The Year of Industrialisation

The "growth at all costs" era is over. As European fintech enters 2026, the market is defined by industrial maturity, strategic consolidation, and regulatory depth. From Lloyds acquiring Curve to the impending Revolut IPO, we analyze the critical trends shaping the year ahead for financial services leaders.

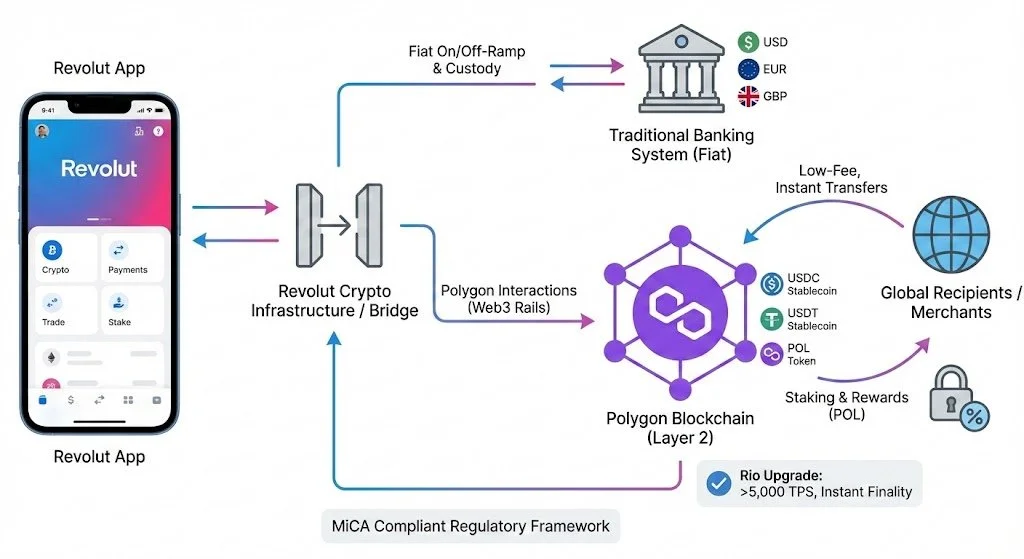

Revolut & Polygon: The $690M Signal for European Fintech & The Future of Settlement

The era of private enterprise blockchains is fading. Revolut’s integration of Polygon—processing nearly $700 million by late 2025—signals a structural shift in European finance. This essay analyzes the convergence of technical scalability (the "Rio" upgrade) and regulatory clarity (MiCA) that is driving the new standard for global settlement.

The Maturity of Money: A New PSD3 Deal Redefines European Payments

Last week’s provisional agreement on PSD3 and the Payment Services Regulation marks the end of the "wild west" in European finance. From a historic liability shift on impersonation fraud to mandatory "human touch" customer support, this deal rewrites the rulebook for banks and fintechs alike. Discover how the new "Constitution of Payments" impacts your operations and compliance roadmap.

The End of the Wild West: CCD2 and the Maturation of European Fintech

The transposition of the Second Consumer Credit Directive (CCD2) signals the end of the "light-touch" regulatory era for European fintech. As "functional symmetry" closes the loopholes that fueled the BNPL boom, founders and executives face a critical pivot. This essay explores the restructuring of unit economics, the friction of mandatory credit checks, and why the industry's future belongs to those who can master the "double lock" of CCD2 and the AI Act.

MPE 2026: Your Guide to Europe's Top Merchant Payments Event

As the payments industry grapples with the seismic shifts of AI, the mainstreaming of real-time account-to-account (A2A) payments, and the complexities of digital identity, one event stands out as the forum for navigating this new reality: Merchant Payments Ecosystem (MPE) 2026.

AI Act & Fintech: A Guide to Article 50, DORA, and PSD3 Compliance

The European Commission, through its new European AI Office, has initiated a foundational effort to regulate the outputs of generative artificial intelligence, signaling a new era of mandatory transparency for the financial sector. This is not a routine update; it is a structural shift in regulatory expectations that will touch every AI-driven customer interaction, internal report, and fraud detection system.

Operation Chargeback: Unmasking €300 Million in Fintech Fraud

"Operation Chargeback" dismantled a €300M global fraud ring, but the investigation found more than just theft. It uncovered alleged complicity from executives inside four German payment firms and a shocking link to Wirecard fugitive Jan Marsalek. This analysis breaks down how the scandal, combined with the systemic failure of German regulator BaFin , creates an urgent imperative for centralized EU regulatory reform to save its fintech sector.

Western Union’s Stablecoin: A 174-Year-Old Remittance Giant Embraces Crypto

Western Union is taking a crypto-native swing at cross-border payments with a USD-backed stablecoin (USDPT) issued by Anchorage Digital Bank and set to run on Solana from 2026. For a 174-year-old remittance leader, this is a signal that the cheapest, fastest corridors will be built on programmable dollars.

Conversational Commerce: OpenAI-PayPal Partnership and LLM-Fintech Integration

In a fascinating development for the payments industry, OpenAI and PayPal have just announced a landmark partnership making PayPal the first-ever payments wallet embedded in ChatGPT. Launching in 2026, this integration will enable 700 million weekly ChatGPT users to discover, purchase, and track goods seamlessly within conversations, powered by PayPal's Agentic Commerce Protocol.

Navigating the AI Frontier: The UK's Sandbox Strategy

On October 21, 2025, at the Times Tech Summit in London, UK Technology Secretary Liz Kendall unveiled the UK’s blueprint for AI regulation, centered on the creation of "AI Growth Labs" equipped with regulatory sandboxes.

Cross-Border Payments: Recent Developments and Future Horizons

Cross-border payments, the financial lifelines enabling international trade, remittances, and global commerce, are having a moment. Traditional systems, reliant on correspondent banking networks, have long been plagued by high costs slow settlement times and opacity. However, recent innovations are addressing these pain points through technological advancements, regulatory collaborations, and infrastructure upgrades.

DORA and the Supply Chain Reckoning: Rethinking Third-Party Risk for a Resilient Financial Sector

The Digital Operational Resilience Act (DORA) is more than a regulatory milestone—it’s a mirror reflecting the financial sector’s digital dependencies. Fully applicable across the EU since January 2025, DORA is forcing institutions to confront an uncomfortable truth: the resilience of their supply chains is only as strong as the weakest link they barely see.

Europe's Push for Digital Sovereignty: The Launch of a MiCAR-Compliant Euro Stablecoin by Nine Major Banks

In a landmark move signaling Europe's ambition to reclaim control over its digital financial landscape, nine prominent European banks have united to develop a euro-denominated stablecoin. This consortium, comprising ING, Banca Sella, KBC Bank & Verzekering, Danske Bank, DekaBank, UniCredit, SEB, CaixaBank, and Raiffeisen Bank International AG, aims to introduce a blockchain-based payment instrument that complies fully with the EU's Markets in Crypto-Assets Regulation (MiCAR).

Want to say hello or find out more? Contact us.

info@contextuals.de

www.contextualsolutions.de

Contextual Solutions

Berlin, Germany