Revolut & Polygon: The $690M Signal for European Fintech & The Future of Settlement

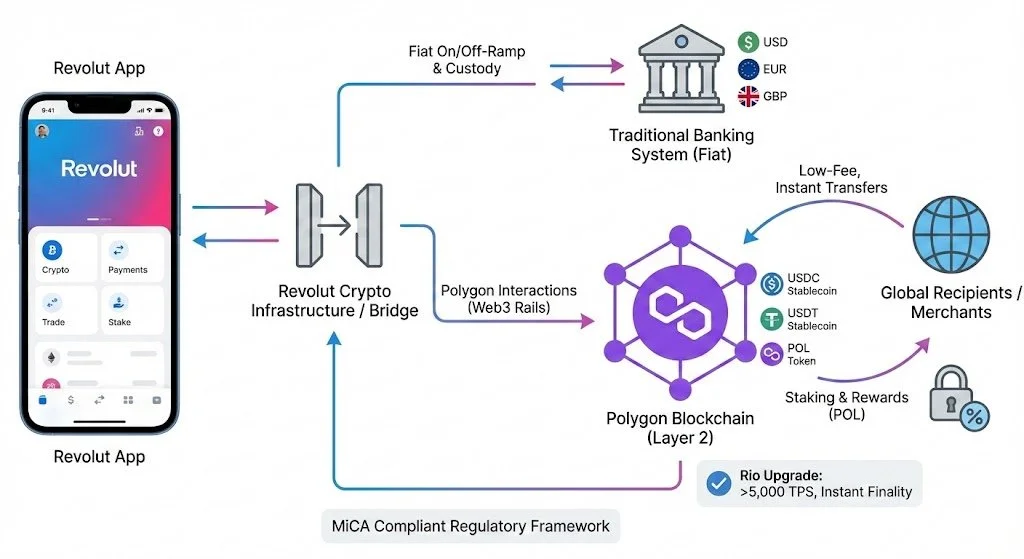

For the better part of a decade, the "blockchain in banking" narrative was dominated by private, permissioned ledgers. Expensive experiments that largely failed to scale. The announcement that Revolut, Europe’s premier neobank with over 65 million users, has integrated the public Polygon network for payments and settlement marks the definitive end of that era.

The headline figure ($690 million in processed volume by November 2025) is significant not because of its size relative to global payments (which remains small), but because of its composition. This volume is not driven solely by speculative trading. It is driven by utility: stablecoin transfers (USDC, USDT), cross-border remittances, and payment settlements.

For Europe’s finance ecosystem, this development signals a shift in the wind. The question is no longer "Will we support crypto?" but "Which rail will we use for settlement?" Revolut’s choice of Polygon, following similar moves by Stripe and institutional pilots by BlackRock, suggests that the market is coalescing around high-throughput, Ethereum-compatible Layer 2s as the standard for value exchange.

The Technical Catalyst

To understand why this integration is happening now, one must look "under the hood" at the infrastructure. For years, public blockchains were considered too slow, too expensive, or too unreliable for bank-grade payments.

The turning point was Polygon’s "Rio" upgrade, deployed in October 2025. While often discussed in technical forums, its implications for the C-suite are purely commercial. The upgrade introduced two critical features that made the Revolut integration viable:

The introduction of the Validator-Elected Block Producer (VEBloP) mechanism eliminated the risk of "reorgs" (where a transaction is confirmed and then reversed). For a bank like Revolut, settlement must be final. Rio reduced finality time to near-instant levels, allowing blockchain transactions to settle faster than many SEPA Instant transfers, and certainly faster than SWIFT.

With the network now capable of sustained speeds of 5,000 transactions per second (TPS), the "congestion" fears that plagued the 2021 bull market have been engineered away. This creates a predictable cost basis—transactions settle for fractions of a cent, regardless of network load.

For developers and CTOs in the financial sector, the lesson is clear: The "scalability trilemma" is being solved. We are entering an era of "invisible blockchain," where the end-user sees a generic "Send Money" button, but the settlement rail involves a stablecoin moving over a Layer 2 network.

The Regulatory Moat

The United States spent 2024 and 2025 entangled in enforcement actions and regulatory ambiguity. Europe, conversely, built a garden. The full implementation of the Markets in Crypto-Assets (MiCA) regulation has provided the legal certainty required for a regulated bank like Revolut to make this move.

Under MiCA, stablecoins like USDC are clearly defined as E-Money Tokens (EMTs). This classification is vital. It allows Electronic Money Institutions (EMIs) and banks to handle these assets with a clear understanding of capital requirements, redemption rights, and custody rules.

Revolut’s ability to offer "native on-ramps" (converting Fiat to Stablecoins instantly) is a direct product of this regulatory clarity. They are not operating in a grey area; they are operating within a framework that the ECB and national regulators understand.

For European founders, this is a competitive advantage. While US competitors hesitate due to SEC oversight, European firms can build compliant, stablecoin-native products today. The integration demonstrates that compliance is no longer a blocker to innovation; it is the prerequisite for institutional scale.

The Market Direction

In 2025, the most valuable user is not the one who trades stocks, but the one who keeps their salary and spending velocity within the ecosystem. By integrating stablecoins on Polygon, Revolut is attacking the cross-border remittance market—historically a high-margin stronghold for legacy banks.

The Proposition: A user can send USDC to a family member in Asia or Latin America instantly, for near-zero fees, directly from their banking app.

The Threat: Legacy banks relying on 3% FX spreads and T+2 settlement times are now competing against a provider offering T+0 settlement at <0.1% cost.

Furthermore, the ability to "stake" POL (Polygon’s native token) within the app introduces a new yield product to the retail mass market. This blends "DeFi" (Decentralized Finance) yield mechanics with "TradFi" (Traditional Finance) user experience. As interest rates in the Eurozone fluctuate, the ability to offer diversified yield sources becomes a key retention tool.

The "Rail Agnostic" Future

We are witnessing the "unbundling" of the bank and the "rebundling" of the fintech. The Revolut case study offers three distinct directives for 2026:

In 2020, every bank wanted to build a private blockchain. In 2025, the liquidity is on public Layer 2s. The winning strategy is integration, not isolation. Use the "AggLayer" (Aggregation Layer) thesis—connect to where the users and assets already are.

If your roadmap does not include a strategy for accepting or settling in E-Money Tokens (EMTs), you are effectively shorting the future of payments. The friction of fiat rails is becoming a competitive disadvantage.

Use MiCA compliance as a trust signal. Institutional partners (like BlackRock and payment processors) will only interface with fully regulated entities.

Conclusion

Revolut’s $690 million volume on Polygon is a "shot heard 'round the world" for the European financial sector. It validates the thesis that public blockchains can handle enterprise load. It proves that regulation (MiCA) accelerates, rather than stifles, adoption. And it warns incumbents that the speed of money is increasing.

For the European fintech ecosystem, the message is clear: The infrastructure phase is over. The deployment phase has begun. The winners of the next cycle will not be those who talk about blockchain, but those who invisibly weave it into the fabric of everyday finance.