Prediction: The 28th Regime Arrives in 2026, As a Wallet

The Ghost of Delaware

For twenty years, European policymakers, founders, and investors have chased a ghost: the "European Delaware." The dream is simple; a unified corporate structure, often referred to as the "28th Regime," that would allow a startup to incorporate once and operate seamlessly across the entire Single Market. It is the holy grail of European competitiveness, the missing link that would finally allow a company in Lyon to scale as frictionlessly as a company in Los Angeles.

The consensus view has always been that this requires a political miracle. It implies that France, Germany, and twenty-five other nations must agree to harmonize their corporate taxes, labor laws, and insolvency procedures into a single "EU Inc." statute. Because of this monumental political hurdle, the project has stalled for decades. The "Societas Europaea" (SE) exists, but it is a tool for giants like Allianz and BASF, far too complex and expensive for the seed-stage startup.

However, while the politicians have been deadlocked on tax codes, there’s more serious work taking place on the technological infrastructure of the continent. The 28th Regime might arrive in the form of a wallet.

The solution to Europe’s fragmentation isn't to erase national borders through legislation; it is to render them frictionless through identity. By leveraging the European Digital Identity (EUDI) Wallet, the EU could build a "Digital Delaware"; a layer of trust infrastructure that allows a founder to shop for the best jurisdiction instantly, effectively bypassing the bureaucratic gatekeepers of the old world.

The Notary and the Nightmare

To understand the magnitude of this shift, one must first appreciate the archaic reality of doing business in Europe’s largest economies today. In Germany, incorporating a GmbH (Limited Liability Company) is a painful administrative ritual. It requires the physical presence of the founders before a notary, who must read the entire deed of incorporation aloud, word for word. This process costs thousands of euros and can take weeks or even months to finalize.

For a continent desperate to compete with the speed of Silicon Valley and Shenzhen, this is a fatal flaw. The friction of starting a business in Europe is about momentum as much as it is about money.

The political solution (forcing Germany to abolish the notary requirement) has proven impossible. The notarial lobbies are powerful, and the cultural attachment to "legal certainty" through physical verification is deep-seated. This is where the "28th Regime" debate usually dies.

But the digital wallet approach offers a workaround. You don’t need to force Germany to change its laws if you can make it effortless for a German founder to incorporate somewhere else, if they prefer.

The Trojan Horse

The foundation of this new regime is eIDAS 2.0, the regulation that mandates every EU member state to offer a Digital Identity Wallet to its citizens. Initially marketed as a way to store driving licenses and access government portals, the ambition has quietly expanded to the corporate world.

The potential turning point came with the European Commission’s proposal in November 2025 for the "European Business Wallet" (officially the "Digital Identity for Legal Persons"). This proposal is the catalyst that could transform the wallet from a consumer convenience into a macroeconomic tool.

The "Business Wallet" does two radical things:

It links the Founder to the Firm: It allows a CEO to cryptographically prove their authority to sign for a company without needing a paper trail or a commercial register extract.

It Validates the "Qualified Electronic Signature" (QES): Under the regulation, a QES has the exact same legal standing as a handwritten signature in the presence of a witness.

This is the "Trojan Horse." By mandating that all member states must accept the QES and the Wallet for cross-border public services, the EU has effectively legislated the obsolescence of the physical notary for international business, without ever having to pass a "Corporate Law" bill.

The Mechanism

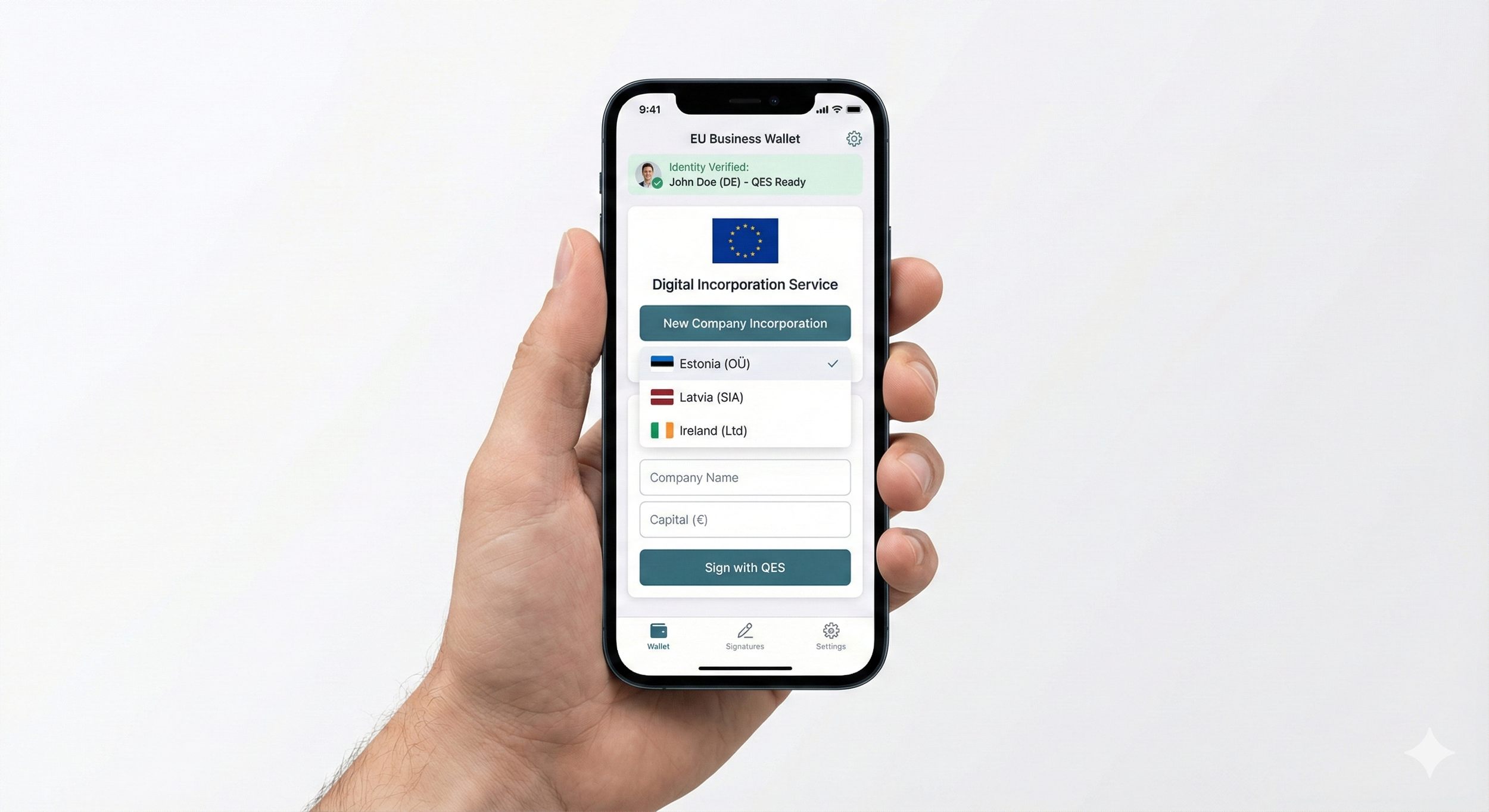

Let us imagine the user journey in late 2026, when this infrastructure is fully operational.

A team of founders in Berlin wants to start a deep tech company. In the old world, they would be forced to navigate the German bureaucracy, pay the notary fees, and wait for the Handelsregister (commercial register) to process their paperwork.

In the new "Wallet Regime," the process looks like this:

The Identity Layer: The founders open their German EUDI Wallet apps. Their identities are already verified at the highest security level (LoA High) by the German state.

The Jurisdiction Shop: They choose to incorporate in Latvia. Why Latvia? Because Latvia (along with Estonia) has positioned itself as the "Digital Delaware" of Europe. It offers 0% corporate tax on reinvested profits, a fully English-language interface, and an API-first commercial register.

The One-Click Incorporation: They log into the Latvian Enterprise Register using their German wallets. The system instantly recognizes their credentials. They sign the standard articles of association using their QES.

The Instant Birth: The company is formed in minutes. The Latvian register issues a "Business Credential" directly back into the founders’ wallets.

The Banking Unlock: This is the most critical step. The founders walk into a bank (or open a fintech app) in France, where they have their first customer. The bank asks for KYC (Know Your Customer) documents. Instead of sending notarized, apostilled translations of a German deed, the founders simply "tap" their Business Wallet. The bank verifies the cryptographic token against the EU blockchain ledger (EBSI). The account is open.

The company is legally Latvian, physically in Berlin, and banking in Paris. The total administrative friction was near zero. The "28th Regime" is the portability of the legal entity.

The Market for Governance

This mechanism introduces a fun concept for European bureaucrats: Jurisdictional Competition.

Once the friction of distance is removed, member states are forced to compete for incorporations based on the quality of their service. If a German founder can incorporate in Ireland or Estonia in 20 minutes from their smartphone, then German notaries loses the captive audience that sustained their clumsy bureaucracy.

This creates a bifurcation of Europe into "Wallet-Native" and "Legacy" jurisdictions:

The Aggregators (The Winners): Countries like Estonia, Latvia, Ireland, and potentially Portugal will aggressively optimize their laws to be "Wallet-Ready." They will become the administrative backends for the continent's startups, collecting registration fees and building ecosystems of legal and financial services.

The Incumbents (The Losers): Countries like Germany, Spain and Italy face a choice. They can either digitize their own processes to compete (which isn’t unpopular, but involves fighting against some domestic interest groups) or watch as their next generation of high-growth companies legally migrates abroad while physically staying put.

This competition is far more effective at driving reform than any directive from Brussels. The threat of a "digital exodus" will force modernization where political negotiation failed.

The Investment Opportunity

For investors, this shift could signal a move away from "RegTech" software (which tries to manage paper processes) toward "Trust Infrastructure."

The heroes of this new regime are the Qualified Trust Service Providers (QTSPs). These are the companies authorized to issue the digital certificates that power the QES and the Wallet. They are the "digital notaries" of the 21st century.

Companies like ZealiD (Sweden), InfoCert (Italy), or Dokobit (Lithuania) are building the rails for this transaction layer. Even US giants like DocuSign act as QTSPs in Europe to ensure their signatures hold up in court. The value proposition here is immense: every time a "Business Wallet" is used to sign a contract, open an account, or file a tax return, a micro-transaction occurs on the trust layer. It is the Visa/Mastercard network of legal compliance.

The Invisible Revolution

The "28th Regime" was unlikely to be signed with a golden pen in a treaty hall. That was a misunderstanding of how Europe works. Europe works best when it builds infrastructure that makes national differences irrelevant.

We saw this with the Euro (removing the friction of exchange rates) and Schengen (removing the friction of borders). The Business Wallet is the third pillar: removing the friction of corporate identity.

By 2030, we will hopefully look back and realize that the "European Delaware" wasn't a place on a map. It was an app on our phones. The startups of the future will be "European" not because of a grand political statute, but because their legal existence is fluid, digital, and completely untethered from the paper-and-stamp bureaucracy of the past.

So, the 28th Regime may finally arrive in 2026, in the form of a wallet.