DXC & Ripple: A Catalyst for Blockchain Integration in Global Finance

Strategic partnerships between traditional banking infrastructure providers and blockchain innovators are reshaping how institutions engage with digital assets.

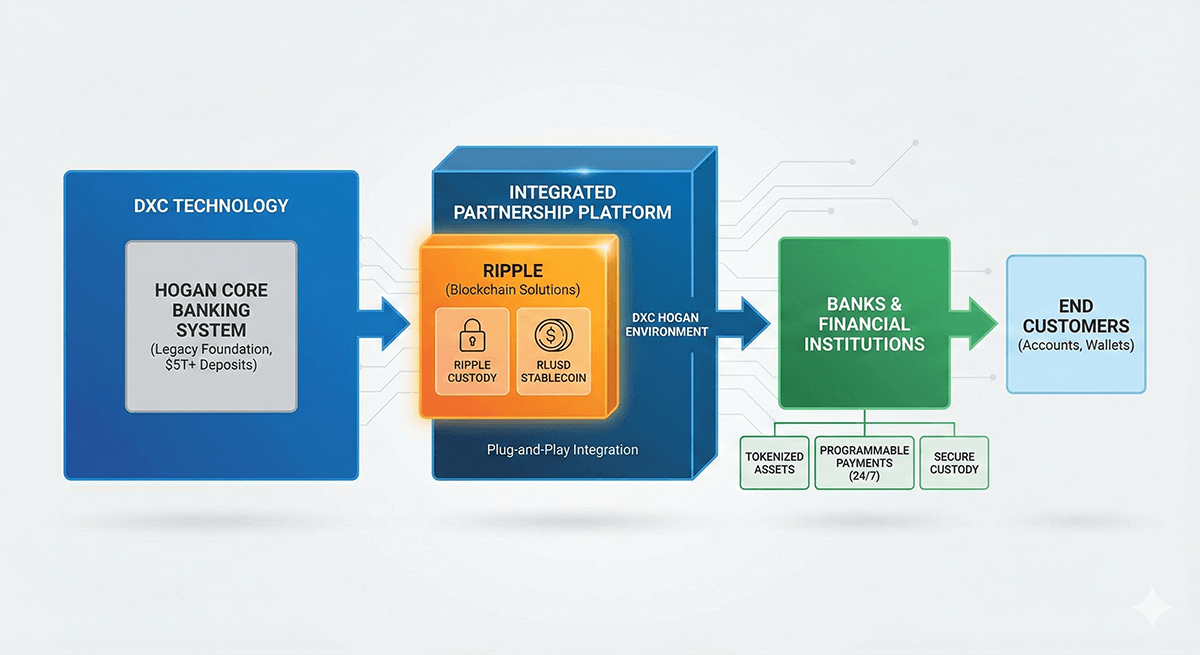

On January 21, 2026, DXC Technology, a Fortune 500 IT services giant, announced a groundbreaking partnership with Ripple, the San Francisco-based fintech firm known for its cross-border payment solutions and the XRP Ledger. This collaboration integrates Ripple's digital asset custody platform, Ripple Custody, and its USD-pegged stablecoin, RLUSD, directly into DXC's Hogan core banking system—a platform that manages over $5 trillion in global deposits and supports more than 300 million accounts. The move allows banks to offer tokenized asset services, programmable payments, and secure custody without the need for costly overhauls of existing systems.

This partnership arrives at a pivotal moment for the fintech and finance industries, particularly in Europe, where regulatory frameworks like the Markets in Crypto-Assets (MiCA) regulation are fostering a more structured environment for digital assets. For the finance industry, and fintech insurgents, the implications are profound: it bridges the gap between legacy banking and decentralized finance (DeFi), potentially unlocking new revenue streams while enhancing operational efficiency. This essay explores the partnership's mechanics, its specific ramifications for European fintech under MiCA, and its broader effects on the global finance sector, arguing that it represents a quiet revolution in institutional blockchain adoption—one that prioritizes seamless integration over disruptive innovation.

To understand the significance, it's essential to contextualize the players involved. DXC Technology, formerly part of Hewlett Packard Enterprise, specializes in modernizing core banking systems for large institutions. Its Hogan platform is a battle-tested suite used by major banks worldwide, handling everything from deposit management to transaction processing. Ripple, on the other hand, has long positioned itself as a bridge between traditional finance and blockchain. Founded in 2012, the company gained prominence through its RippleNet payment network, which leverages the XRP cryptocurrency for fast, low-cost cross-border transfers. More recently, Ripple has expanded into stablecoins with RLUSD, a regulated USD-backed token launched in late 2024, designed for institutional use cases like payments and asset tokenization. RLUSD operates on both the XRP Ledger and Ethereum, ensuring interoperability, and has seen rapid growth, reaching a $1.4 billion market cap by early 2026.

Fertile Ground for Innovation

The European fintech scene provides fertile ground for this alliance. Europe has been at the forefront of digital finance innovation, with initiatives like the digital euro project and SEPA (Single Euro Payments Area) aiming to streamline payments across borders. Ripple's prior integrations, such as with Germany's DZ Bank for custody services and connections to TAS Network Gateway for SEPA compatibility, demonstrate its growing footprint in the region. DZ Bank, managing €350 billion in assets, adopted Ripple Custody in mid-2025, signaling early institutional traction. These moves align with broader trends: European banks are increasingly exploring tokenized assets, with projections estimating the tokenized real-world assets (RWAs) market to reach $10 trillion by 2030.

Mechanics of the DXC-Ripple Integration

At its core, the DXC-Ripple partnership embeds Ripple's technology into Hogan's architecture, enabling banks to custody digital assets, process RLUSD-based payments, and tokenize RWAs seamlessly. This "plug-and-play" approach is key: banks can connect traditional accounts to blockchain wallets without disrupting mission-critical operations. For instance, institutions can now offer 24/7 settlement, programmable smart contracts for automated payments, and secure storage for stablecoins and cryptocurrencies—all while maintaining compliance with anti-money laundering (AML) and know-your-customer (KYC) standards. Ripple's VP, Joanie Xie, emphasized that the integration brings "digital asset custody, RLUSD, and payments directly into the core banking environments institutions already trust." While XRP is leveraged in Ripple's ecosystem for liquidity, the focus here is on RLUSD as a stable entry point, with potential for XRP's use in cross-border scenarios.

Complementing with Consumer-Facing Innovation

Complementing this backend focus is Revolut's recent partnership with Polygon, Europe's largest neobank with over 65 million users across 38 countries. This integration enables zero-fee remittances using stablecoins like USDC and USDT, POL token staking, crypto-funded card payments, and seamless on- and off-ramps to fiat. By November 2025, Revolut had already processed $690 million in transactions on Polygon, demonstrating real-world scale. Users benefit from low-cost, borderless transfers—often fractions of a penny per transaction—and the ability to pay for everyday purchases with crypto cards, blending web3 efficiency with traditional finance familiarity. For Revolut, this positions it as a leader in embedded crypto services, catering to its 14 million crypto-active users and expanding revenue through staking yields and trading fees.

Transformative Potential Under MiCA Regulation

For European fintech and finance, this partnership holds transformative potential, especially under MiCA, which came into full effect in 2024. MiCA provides a harmonized regulatory framework across the EU, classifying stablecoins like RLUSD as e-money tokens and requiring issuers to hold full reserves and obtain licenses. By aligning with these rules, the DXC-Ripple solution lowers compliance barriers, allowing banks to experiment with crypto services confidently. In a region where 40% of banks are planning blockchain pilots by 2027, this could accelerate adoption rates significantly.

One major implication is enhanced cross-border efficiency. Europe's fragmented payment systems have long been a pain point, with SEPA transfers often taking days. Ripple's technology, now embedded in core banking, enables near-instant settlements using RLUSD, reducing costs by up to 70% compared to traditional SWIFT networks. This dovetails with the European Central Bank's (ECB) digital euro ambitions, where offline and interoperable solutions are being developed with partners like Giesecke+Devrient and Worldline—both Ripple collaborators. Analysts suggest this positions Ripple as "CBDC infrastructure in disguise," potentially integrating with central bank digital currencies (CBDCs) for hybrid models.

For fintech startups, the partnership democratizes access to institutional-grade tools. Smaller players can leverage DXC's platform to offer DeFi-linked products, such as yield-bearing stablecoin accounts or tokenized real estate, without building from scratch. This could spur innovation in areas like embedded finance, where apps integrate crypto custody seamlessly. Finance executives in Europe, facing pressure from neobanks like Revolut (which already offers crypto trading), will find this a competitive edge. Revenue opportunities abound: custody fees alone could generate billions, while tokenization opens doors to new asset classes like RWAs, projected to add $500 billion in liquidity to European markets by 2030.

Global Impacts, Challenges, and Future Outlook

Broader industry impacts extend beyond Europe. Globally, core banking providers like FIS, Temenos, and Oracle are racing to incorporate blockchain, and DXC's move sets a precedent. It signals a shift from crypto as a speculative asset to a utility layer in finance, potentially influencing U.S. banks post-SEC clarity on XRP. For finance leaders, it means rethinking risk: while secure custody mitigates hacks, integration exposes systems to blockchain volatility. However, with Ripple's track record—processing over $30 billion in payments annually—the benefits outweigh risks for many.

Challenges remain. Regulatory divergence outside the EU, such as stricter U.S. stablecoin rules, could slow global rollout. Integration costs, though reduced, still require IT investments, and scalability issues during high-volume periods must be addressed. Looking ahead, as tokenized assets proliferate, this partnership could evolve to include advanced features like Ripple's planned "Prime" services for multi-chain interoperability.

In conclusion, the DXC-Ripple alliance is another solid example of mainstreaming blockchain in finance. For European fintech, it accelerates MiCA-compliant innovation, fostering a hybrid ecosystem where traditional and digital assets coexist. Globally, it heralds an era of embedded crypto infrastructure, promising efficiency, new revenues, and competitive advantages. As Sandeep Bhanote of DXC noted, it's about connecting "traditional accounts, wallets, and decentralized platforms at enterprise scale." Finance executives who overlook this may find themselves playing catch-up in a tokenized world.