The End of the Wild West: CCD2 and the Maturation of European Fintech

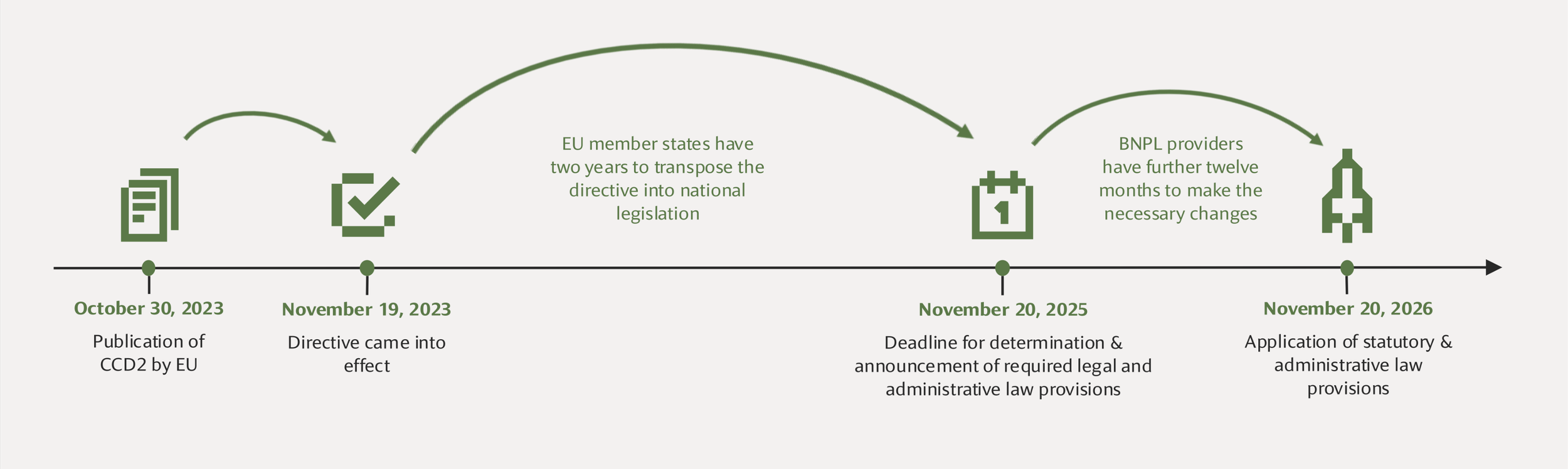

As of today, November 20, 2025, European fintech has crossed a regulatory Rubicon. The transposition deadline for the Second Consumer Credit Directive (CCD2) marks the end of the "light-touch" era that facilitated the rise of Buy Now, Pay Later (BNPL) and digital micro-lending.

For nearly a decade, fintech innovators thrived in the legislative gaps of the original 2008 directive, building billion-euro companies on frictionless user experiences and algorithmic speed. Those gaps have now been closed. As Member States integrate Directive (EU) 2023/2225 into national law, financial services executives and founders face a new reality: less "move fast and break things", and more "verification first."

This is a significant restructuring of digital lending. The question for fintechs is now about survival in a market where the regulatory moat around incumbents has just been deepened.

Closing the Digital Loophole

The genius of the first wave of BNPL and micro-lending fintechs lay in their ability to arbitrage the definitions of the 2008 Consumer Credit Directive (CCD1). By keeping loans under €200 or structuring them as interest-free repayments within three months, companies like Klarna, Affirm, and countless smaller players effectively operated outside the heavy compliance burden of traditional banks. This allowed for the "one-click" checkout experience that revolutionized e-commerce conversion rates.

The new directive explicitly removes the minimum threshold, bringing loans from €0 to €200 under supervisory purview. Furthermore, it brings "interest-free" credit and loans with "insignificant charges" squarely into scope, provided they involve a third party. This legislative shift is driven by the principle of "functional symmetry"—the idea that if a product functions as credit, it must be regulated as credit, regardless of the technological interface or the lender's label.

The regulatory "free pass" for split-payment products is revoked. The €50 sneaker purchase split into three payments now carries a compliance overhead comparable to a traditional personal loan. This change threatens to invert the unit economics of the micro-ticket BNPL model. If the fixed cost of a compliant credit check and data processing is €1.50, applying that to a €30 transaction destroys the margin, whereas applying it to a €1,000 purchase is negligible. Consequently, we expect a "flight to quality" where BNPL providers abandon the low-value, high-velocity fashion segment in favor of higher-value durables like electronics and furniture, where margins can absorb the compliance tax.

A Farewell to "One-Click"

The most disruptive operational change introduced by CCD2 is the rigorous tightening of creditworthiness assessments (Article 18). Under the previous regime, many fintechs relied on "soft" checks, internal repayment history, or simple self-declaration of income to approve loans in milliseconds. CCD2 mandates that lending decisions must now be based on "sufficient, accurate and up-to-date information" regarding the consumer’s income and expenses.

This spells the end of the instant, invisible approval. Lenders will be forced to verify income, likely through Open Banking (PSD2) APIs or direct database queries. While Open Banking offers a technological solution, it introduces friction. Asking a consumer to log in to their bank account to approve a €60 purchase creates a "speed bump" that could significantly increase cart abandonment rates.

Moreover, the reliance on verifiable data creates a paradox of financial inclusion. Fintechs often championed their ability to serve the "unbanked" or "thin-file" customers ignored by traditional banks. However, by mandating strict verification of disposable income, CCD2 may force lenders to reject these very demographics. Industry estimates suggest approval rates for certain high-risk segments could drop by up to 30% as lenders tighten their funnels to avoid regulatory penalties for "irresponsible lending."

“We contribute to this literature by providing suggestive evidence that hurdles to entering the credit market, such as low credit scores or the inability to establish a public credit track record, can potentially be mitigated through BNPL usage. Small loans like BNPL, which are not reported to general credit registers, enables consumers to build a credit reputation nearly costlessly. This improved reputation can facilitate access to bank credit, promote better repayment behavior, and simultaneously o!er returns to banks.”

The AI "Double Lock"

Fintech lenders are not only facing CCD2; they are simultaneously navigating the implementation of the EU AI Act. The interplay between these two regulations creates a complex "double lock" on algorithmic lending. The AI Act classifies credit scoring systems as "High Risk," triggering requirements for conformity assessments, data governance, and bias mitigation.

Simultaneously, CCD2 introduces a "right to human intervention" and a "right to explanation." Article 18(8) grants consumers the right to request a human review of any automated credit decision and to receive a meaningful explanation of why they were rejected. This strikes at the heart of the "black box" AI models used by advanced fintechs. If a neural network denies a loan based on a complex, non-linear correlation of thousands of data points, explaining that decision in "meaningful" terms to a layperson is technically profound and legally perilous.

“According to Article 18(8)(c), a consumer might request a review of the assessment of the creditworthiness and the decision, which means that a human must be able to verify an outcome of automated data processing. Therefore, Article 18(8) also provides for some form of human oversight in creditworthiness assessment.”

This creates a significant operational liability. If even 1% of rejected applicants exercise their right to human review, fintechs operating at scale (processing millions of applications) will need to hire armies of human underwriters, effectively reversing the automation gains that defined their business models. To mitigate this, we are likely to see a regression in sophistication, with lenders reverting to simpler, explainable "rules-based" models (e.g., logistic regression) to ensure compliance, sacrificing predictive nuance for legal safety.

Banks Strike Back

As fintechs grapple with these new burdens, traditional banks find themselves in a position of unexpected strength. Incumbents already possess the robust compliance infrastructure, balance sheets, and the historical transaction data required to perform CCD2-compliant checks without external friction.

For a customer banking with Barclaycard or BNP Paribas, the bank already knows their income and expenditure. It can offer a compliant "pay later" option instantly without an external Open Banking check. This data advantage neutralizes the speed advantage that was once the fintechs' primary weapon.

We are already witnessing a strategic convergence. Pure-play BNPL firms like Klarna are aggressively pivoting to become full-service banks (obtaining licenses and launching deposit products) to access cheaper capital and cross-subsidize their lending costs. Conversely, banks are launching their own "flex" payment products, effectively commoditizing the BNPL feature set.

Consolidation and the M&A Outlook

The high fixed costs of CCD2 compliance will inevitably drive market consolidation. Small, niche BNPL providers and peer-to-peer (P2P) platforms—which are also captured under CCD2 as "credit intermediaries"—will struggle to survive the compression of margins and the cost of building compliant tech stacks.

We predict a wave of distressed M&A activity in late 2025 and 2026. Large financial institutions and dominant fintech platforms will acquire smaller players, not for their loan books (which may be toxic under the new rules), but for their merchant networks and user bases. The market will bifurcate: a few massive, pan-European platforms that resemble digital banks, and a graveyard of smaller players who could not bridge the compliance gap.

Conclusion: The Maturation Phase

November 20, 2025, is not the end of fintech lending in Europe, but it is the end of its adolescence. The sector is entering a maturity phase characterized by lower growth, higher barriers to entry, and a focus on sustainable profitability over gross merchandise value (GMV).

The winning strategy involves vertical integration to control compliance costs, a shift toward higher-value credit products where margins remain healthy, and a rigorous investment in "RegTech" to automate the new burdens of verification and explanation.

The "Wild West" is closed; the era of the digital bank has truly begun.