Contextual Solutions Blog

This page is dedicated to our original and curated content about FinTech, digital banking, LegalTech, and innovation.

EU Inc: Von der Leyen's 2026 Plan to Boost European Tech Innovation and Startups

Ursula von der Leyen's announcement of EU Inc at the 2026 World Economic Forum in Davos represents a pivotal shift for European business and technology. This "28th regime" aims to create a unified pan-European company structure, allowing startups to incorporate online in 48 hours and operate seamlessly across 27 member states. By reducing regulatory fragmentation, EU Inc could enhance tech innovation in AI, defense, and deep tech sectors, fostering European champions amid global competition. However, challenges like implementation details and balancing worker protections remain. This essay delves into the announcement's implications, benefits, and potential hurdles for Europe's tech ecosystem.

Why Europe’s AI Future Lies in the Edge, Not the Cloud

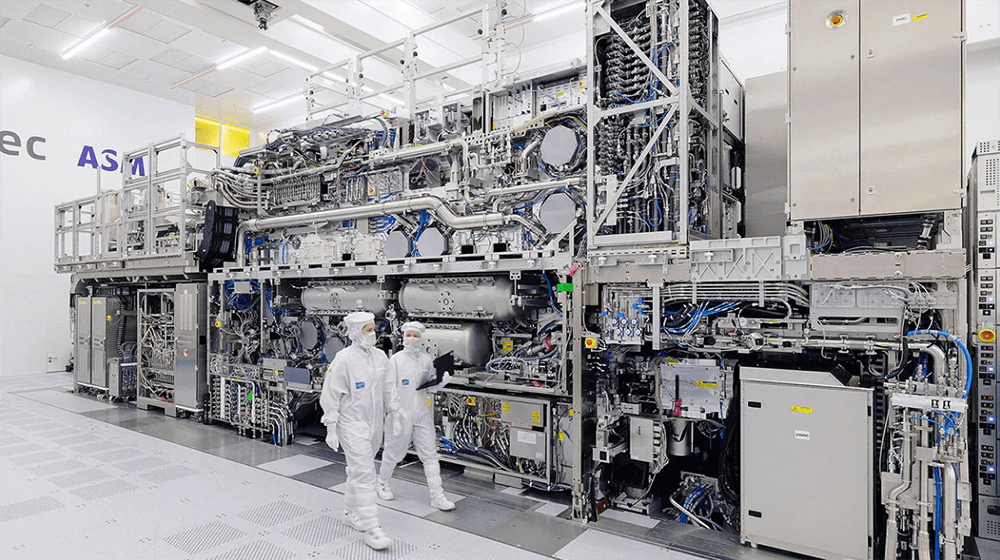

The narrative that Europe has "lost" the AI race is wrong. While the US burns gigawatts to train massive models, Europe is specializing in inference—the efficient, on-device application of AI in the real world. From Mistral’s small models to Axelera’s edge chips, here is how thermodynamics and GDPR are shaping a new, profitable path for European tech.

Prediction: The 28th Regime Arrives in 2026, As a Wallet

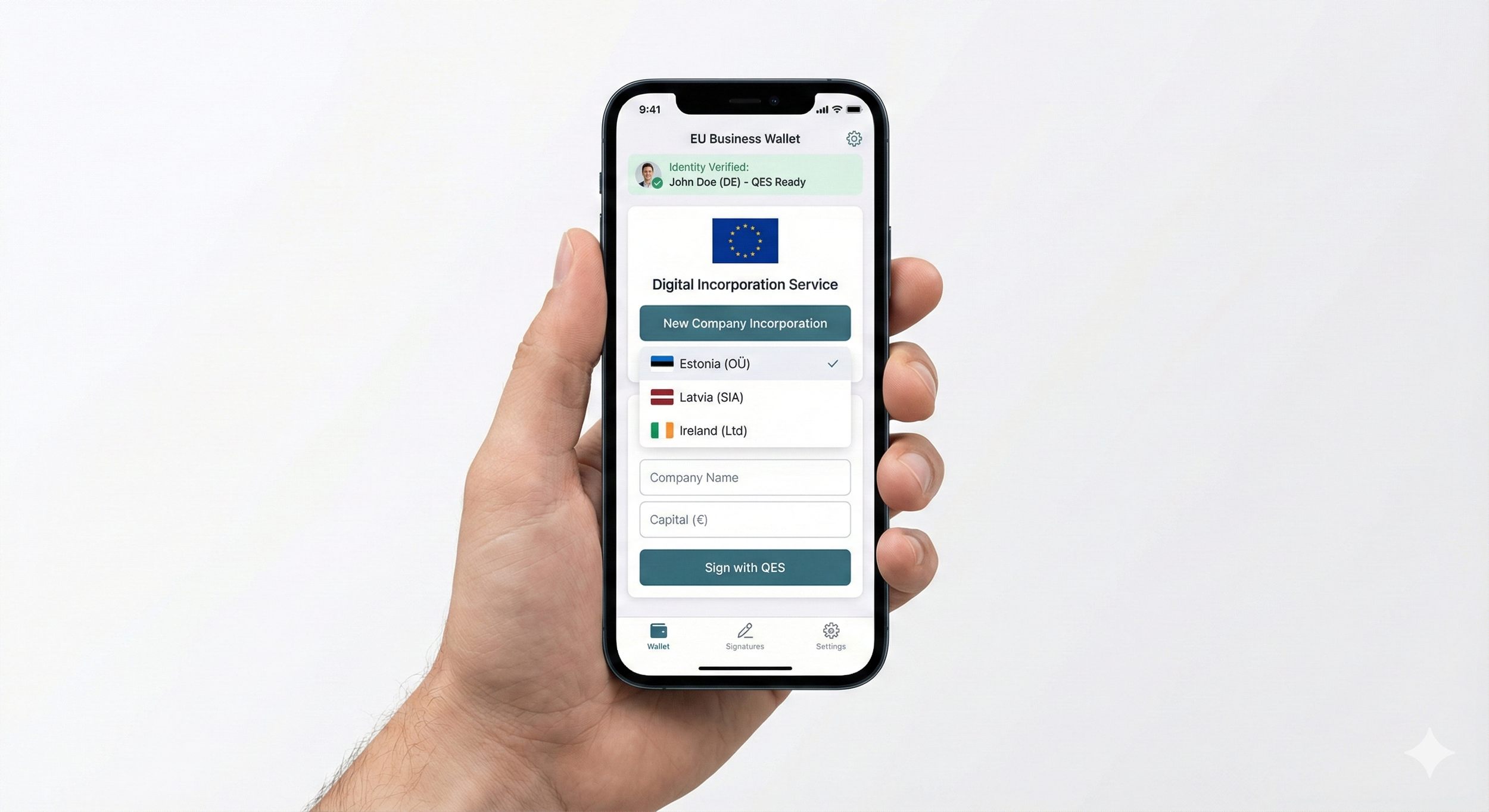

For twenty years, Europe chased the dream of a unified "EU Company" structure. It never happened. Now, a silent revolution is replacing politics with technology. The new European Business Wallet allows founders to bypass local notaries and incorporate anywhere instantly—making the location of your company as fluid as your software. Here is why the "28th Regime" is arriving in 2026 not as a statute, but as an app.

European Fintech Private Market Outlook 2026: The Year of Industrialisation

The "growth at all costs" era is over. As European fintech enters 2026, the market is defined by industrial maturity, strategic consolidation, and regulatory depth. From Lloyds acquiring Curve to the impending Revolut IPO, we analyze the critical trends shaping the year ahead for financial services leaders.

The End of the Wild West: CCD2 and the Maturation of European Fintech

The transposition of the Second Consumer Credit Directive (CCD2) signals the end of the "light-touch" regulatory era for European fintech. As "functional symmetry" closes the loopholes that fueled the BNPL boom, founders and executives face a critical pivot. This essay explores the restructuring of unit economics, the friction of mandatory credit checks, and why the industry's future belongs to those who can master the "double lock" of CCD2 and the AI Act.

Europe's Push for Digital Sovereignty: The Launch of a MiCAR-Compliant Euro Stablecoin by Nine Major Banks

In a landmark move signaling Europe's ambition to reclaim control over its digital financial landscape, nine prominent European banks have united to develop a euro-denominated stablecoin. This consortium, comprising ING, Banca Sella, KBC Bank & Verzekering, Danske Bank, DekaBank, UniCredit, SEB, CaixaBank, and Raiffeisen Bank International AG, aims to introduce a blockchain-based payment instrument that complies fully with the EU's Markets in Crypto-Assets Regulation (MiCAR).

The State of European Fintech in 2025: Insights from Finch Capital's Report

In its 10th edition, Finch Capital's "State of European Fintech 2025" report paints a picture of a maturing sector poised for growth amid global uncertainties. Released amid a resurgence in fintech investments, the report highlights a shift toward concentrated funding, resilient mid-market activity, and the transformative role of AI.

Industrial Policy via Venture Capital: Unpacking the Implications for Europe

Amid calls for coordinated industrial policy, a new study by Martin Aragoneses and Sagar Saxena, "Industrial Policy via Venture Capital" (2025), dissects one promising lever: government-backed VC intermediated through private funds. By analyzing the European Investment Fund (EIF), the authors reveal how public money can amplify private expertise to bridge funding gaps.

Mario Draghi's Report on EU Competitiveness: One Year On – Developments and Perspectives

One year after the release of Mario Draghi's seminal report on "The Future of European Competitiveness" in September 2024, the European Union finds itself at a crossroads. Commissioned by European Commission President Ursula von der Leyen, the 383-page document outlined an "existential challenge" for Europe, warning of sluggish growth, technological lag behind the U.S. and China, and the need for radical reforms.

Compliance Fatigue: Europe’s Financial Services Are Tired

European banks and fintechs face compliance fatigue—slowing onboarding, inflating costs, and creating operational drag. Discover practical, data-backed strategies to streamline processes, leverage AI, and transform compliance from a costly burden into a sustainable competitive advantage.

EU Innovation Policy: Time to Start Funding Ideas, Not Companies?

Despite €100 billion in funding, EU innovation is stagnating. A new report calls for a radical shift: stop funding corporate giants and start empowering independent innovators. Here's what needs to change.

Generative AI in Europe: How the EU Can Lead the Next Technological Revolution

Generative AI is transforming industries across Europe, driving innovation, economic growth, and societal change. This blog explores key insights from the European Commission’s 2025 Generative AI Outlook, highlighting the opportunities, challenges, and regulatory developments shaping the future of AI in the EU.

European Commission Fines Apple and Meta Under Digital Markets Act: A New Era of Tech Regulation

The EU fined Apple and Meta under the Digital Markets Act, enforcing new tech competition rules. Discover the reasons and what's next for tech giants.

Top 10 Trends for the European Tech Scene in 2025

Discover the top 10 tech trends poised to transform Europe in 2025, from AI and spatial computing to DeFi and quantum computing.

Navigating DORA: Could This Be the Turning Point for Digital Resilience in Financial Services and IT in Europe?

Is your financial institution ready for DORA? Understand the requirements, implications, and how to achieve digital resilience in the EU.

European Tech Entrepreneurs in Africa: Can They Succeed?

Can European entrepreneurs succeed in Africa? Learn the opportunities, challenges, and key considerations for bringing tech solutions to the African market.

The Crypto Market Boom or Bust Debate: Is There More to the Crypto Boom, or Was That It for EU Businesses Seeking Revolutionary Digitisation?

Is crypto a good investment in the EU? Analyze market trends, regulations, and the potential impact of Trump's re-election on Bitcoin and Ethereum.

The Future for European AI Companies

European AI faces challenges in funding, talent acquisition, and regulation. Can it overcome these hurdles to become a major player?

How can the European Venture Capital Industry Catch Up with the US? IMF Report Summary

The IMF highlights the stark contrast between EU and US venture capital. Learn about the barriers hindering European startups and how to bridge the gap.

Want to say hello or find out more? Contact us.

info@contextuals.de

www.contextualsolutions.de

Contextual Solutions

Berlin, Germany