The Digital Euro Opportunity

ECB's Blockchain Shift and Global Competition

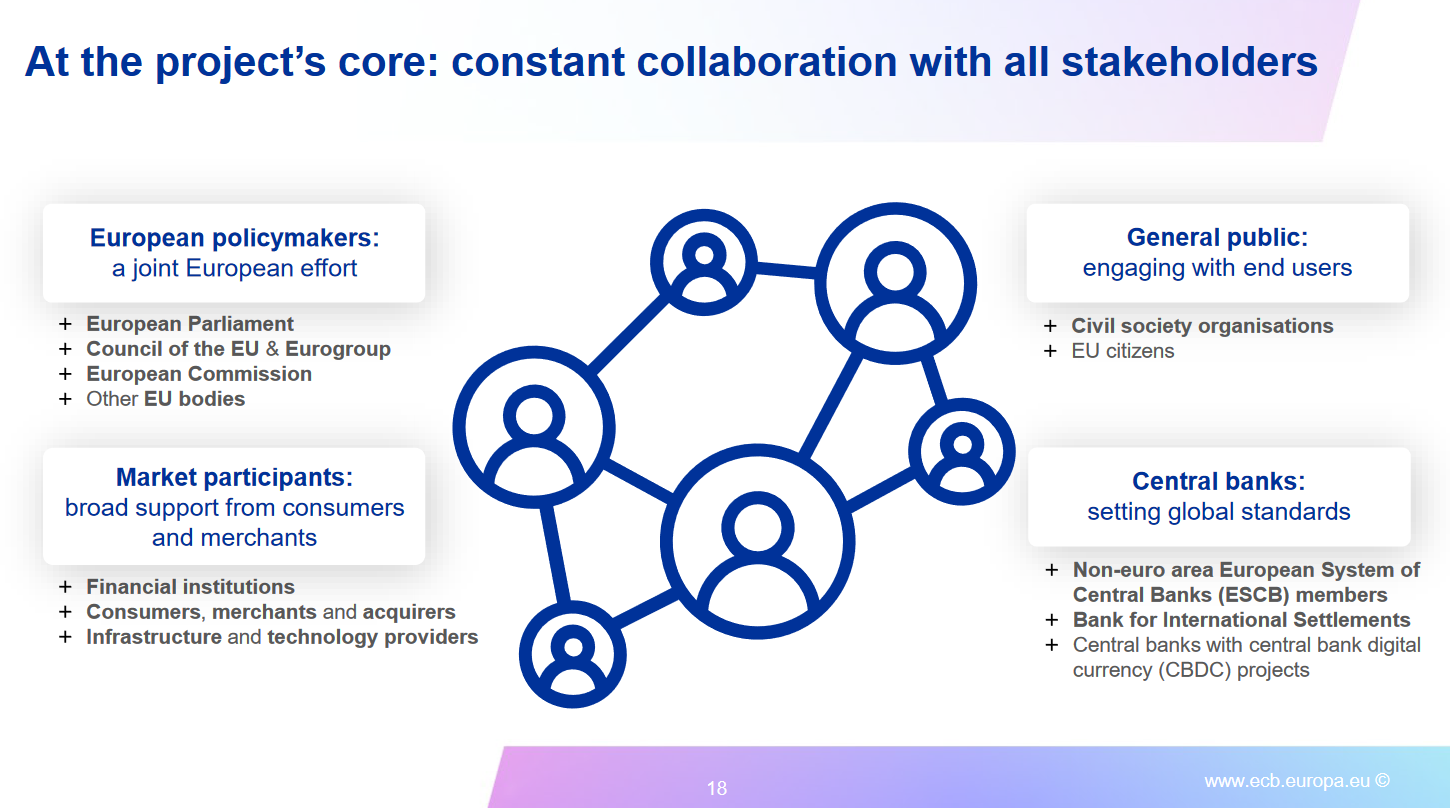

The Digital Euro project represents a pivotal evolution in Europe's monetary landscape, driven by the European Central Bank's (ECB) efforts to modernize central bank money in response to digital transformation and global competition.

As of September 2025, the initiative is in its preparation phase, with a key decision point looming in October when the ECB's Governing Council will assess whether to proceed toward issuance. This phase builds on the investigation stage completed in 2023, focusing on developing standards, procedures, and a visual identity for the potential currency.

Recent pilots have tested technical feasibility, including offline payments and privacy features, amid regulatory momentum from the EU's Markets in Crypto-Assets (MiCA) framework.

At its core, the Digital Euro is envisioned as an electronic form of central bank liability for retail payments, complementing physical cash rather than replacing it. Users would access it via digital wallets provided by banks or public intermediaries, enabling secure, free transactions online, offline, in stores, or person-to-person across the euro area. Unlike volatile crypto-assets, it would maintain stable value backed by the ECB, with features like par convertibility to other euro forms and legal tender status to ensure widespread acceptance. The project aligns with broader EU strategies to enhance payment efficiency, reduce reliance on non-European providers, and promote financial inclusion.

A notable recent development is the ECB's exploration of public blockchains, such as Ethereum or Solana, as infrastructure alternatives to closed private networks. This shift, reported in August 2025, aims to accelerate adoption by enabling global trading, countering the dominance of US dollar-backed stablecoins (e.g., with a $167 billion market cap), and integrating with decentralized finance (DeFi). Ethereum's smart contract capabilities and Solana's scalability make them attractive, potentially allowing the Digital Euro to support programmable money, where payments trigger automatically based on conditions, revolutionizing sectors like supply chains and automated finance. For fintech and banking clients, this could open avenues for innovative services, such as seamless cross-border payments that bypass traditional intermediaries, reducing costs and enhancing speed.

However, this blockchain pivot introduces complexities. Public networks could boost circulation but raise privacy risks, as transactions might be traceable, conflicting with the ECB's commitment to high data protection standards under GDPR and MiCA. MiCA, fully effective since 2024, regulates crypto-assets and stablecoins, requiring the Digital Euro to ensure interoperability without undermining financial stability or enabling market abuse. Interoperability challenges persist, including technical barriers with existing systems like SEPA instant payments and potential conflicts with non-euro stablecoins. The ECB has proposed measures like holding limits (e.g., €3,000 per user) to mitigate disintermediation risks, where mass shifts to the Digital Euro could erode bank deposits and lending capacity.

“Since we believe it is fundamental for a digital euro to be interoperable with other payments infrastructures and requirements like ISO20022, we caution firm decisions on design choices before the FSB work has had the opportunity to embed and better inform the needs and priorities of any such choices. Interoperability will also support innovation and allow industry to provide innovative value-added services for cross currency payments, building on the solutions that already exists in the market today”

- Mastercard response to ECB public consultation on a digital euro

In the context of global competition, the Digital Euro contrasts sharply with China's e-CNY. Launched in pilots as early as 2020, the e-CNY has achieved massive scale, with transaction volumes reaching 7 trillion yuan ($986 billion) by mid-2024 and integration into everyday apps like WeChat. It emphasizes state control, surveillance capabilities, and cross-border expansion, such as through the mBridge project with other central banks. Europe's approach prioritizes privacy, user rights, and market neutrality, avoiding the e-CNY's ties to social credit systems or mandatory adoption. While slower— with no full rollout before 2028 likely—the Digital Euro could foster a more balanced ecosystem, combining CBDC with regulated private crypto under MiCA.

Public education emerges as a critical challenge for adoption. The ECB has launched initiatives like podcasts and stakeholder consultations to demystify the currency and address misconceptions, emphasizing its role in preserving cash-like privacy. However, research indicates that without clear added value (such as superior features over existing digital payments) the Digital Euro may struggle for uptake. Does education truly matter? Yes, for building trust and inclusion, particularly among underserved groups, but the currency's design suggests it will largely function as "rails" behind the scenes. Integrated into familiar platforms, it could power fintech apps without users needing direct awareness, similar to how SEPA underpins euro transfers today. This backend focus might alleviate adoption barriers but risks low engagement if perceived as redundant.

Recent pilots underscore progress and hurdles. In 2025 updates, the ECB tested settlement prototypes using distributed ledger technology (DLT), exploring both centralized and decentralized models. Wholesale CBDC trials, like those for interbank settlements, have shown promise in DLT integration, but retail pilots highlight cybersecurity vulnerabilities and the need for resilient offline capabilities. Amid stalled EU legislation, the ECB presses forward, with a draft rulebook expected by late 2025 providing clarity on distribution and governance.

For financial institutions and fintechs, the Digital Euro presents a double-edged sword. Opportunities in programmable finance and cross-border efficiency could reshape services, but challenges like regulatory compliance and competition with stablecoins demand preparation:

“A digital euro can strengthen the resilience and autonomy of Europe’s payment ecosystem and preserve the relevance of European banks and the euro in the global financial system. But it also has a potential to weaken bank profitability and increase costs, particularly in its initial phase. In the absence of circuit breakers, the higher velocity of money could accelerate runs on bank deposits in a crisis, triggering a liquidity crunch and leading to bank failures.”

- Digital euro A wake-up call for banks to adapt and innovate

As Europe navigates these, the project could set a global standard for sovereign digital innovation, blending decentralization with oversight in a way that democratizes access while safeguarding stability.