Contextual Solutions Blog

This page is dedicated to our original and curated content about FinTech, digital banking, LegalTech, and innovation.

Revolut & Polygon: The $690M Signal for European Fintech & The Future of Settlement

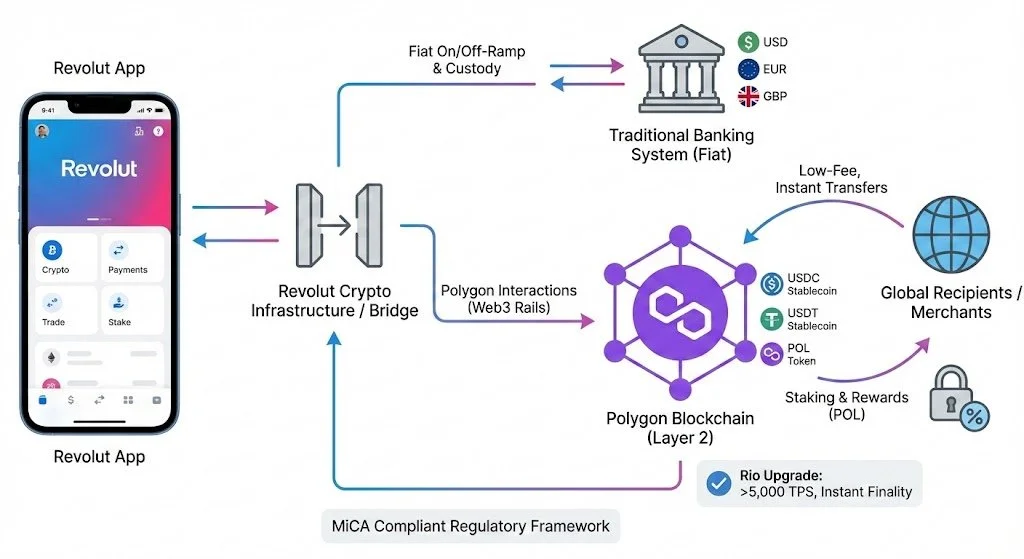

The era of private enterprise blockchains is fading. Revolut’s integration of Polygon—processing nearly $700 million by late 2025—signals a structural shift in European finance. This essay analyzes the convergence of technical scalability (the "Rio" upgrade) and regulatory clarity (MiCA) that is driving the new standard for global settlement.

The Maturity of Money: A New PSD3 Deal Redefines European Payments

Last week’s provisional agreement on PSD3 and the Payment Services Regulation marks the end of the "wild west" in European finance. From a historic liability shift on impersonation fraud to mandatory "human touch" customer support, this deal rewrites the rulebook for banks and fintechs alike. Discover how the new "Constitution of Payments" impacts your operations and compliance roadmap.

The End of the Wild West: CCD2 and the Maturation of European Fintech

The transposition of the Second Consumer Credit Directive (CCD2) signals the end of the "light-touch" regulatory era for European fintech. As "functional symmetry" closes the loopholes that fueled the BNPL boom, founders and executives face a critical pivot. This essay explores the restructuring of unit economics, the friction of mandatory credit checks, and why the industry's future belongs to those who can master the "double lock" of CCD2 and the AI Act.

MPE 2026: Your Guide to Europe's Top Merchant Payments Event

As the payments industry grapples with the seismic shifts of AI, the mainstreaming of real-time account-to-account (A2A) payments, and the complexities of digital identity, one event stands out as the forum for navigating this new reality: Merchant Payments Ecosystem (MPE) 2026.

Operation Chargeback: Unmasking €300 Million in Fintech Fraud

"Operation Chargeback" dismantled a €300M global fraud ring, but the investigation found more than just theft. It uncovered alleged complicity from executives inside four German payment firms and a shocking link to Wirecard fugitive Jan Marsalek. This analysis breaks down how the scandal, combined with the systemic failure of German regulator BaFin , creates an urgent imperative for centralized EU regulatory reform to save its fintech sector.

Conversational Commerce: OpenAI-PayPal Partnership and LLM-Fintech Integration

In a fascinating development for the payments industry, OpenAI and PayPal have just announced a landmark partnership making PayPal the first-ever payments wallet embedded in ChatGPT. Launching in 2026, this integration will enable 700 million weekly ChatGPT users to discover, purchase, and track goods seamlessly within conversations, powered by PayPal's Agentic Commerce Protocol.

The Stablecoin Revolution: How 2025 Is Redefining Money

Stablecoins have grown from niche crypto assets to a $625 billion market in 2025, and they’re on track to reshape global finance. Here’s what businesses, investors, and policymakers need to know to navigate this revolution, per the findings of the Stablecoin Revolution Report by brn.

The Future of Open Banking: Transforming Compliance into Competitive Advantage

Open banking in 2025 brings both challenges and opportunities. Learn how financial institutions can drive innovation, boost consumer trust, and stay ahead of compliance with Contextual Solutions.

BNPL at a Crossroads: How 2025 Regulation Will Reshape the Buy Now, Pay Later Sector?

Buy Now, Pay Later (BNPL) is transforming how consumers shop, but regulatory changes in 2025 aim to curb the rising risks of over-indebtedness. Discover how new UK rules will reshape the BNPL landscape and what businesses must do to stay compliant and competitive.

Beyond Payments: Human-Centric Innovation and Strategic Growth at the Merchant Payments Ecosystem (MPE) 2025

Catch up on the key takeaways from the Merchant Payments Ecosystem 2025! Discover the latest insights on payments.

Exploring the Future of Payments: Key Trends and Innovations in 2024

The payments landscape is steadily evolving – being constantly shaped by factors such as consumer choice and industry-wide developments. How will it shape in 2024? What are the trends? The "Global Overview of Payment Providers 2024" report by the Paypers offers an insightful exploration into the dynamic shifts and strategic innovations defining the payment industry today. Check out our article to access the report summary we prepared for you.

Embracing Generative AI in the Payments Industry

A new report by Visa Consulting and Analytics (VCA) explores the impact of generative AI on the payments industry, outlining payment- specific opportunities to help financial institutions acquire more customers, drive customer engagement, and improve the customer experience for optimal growth. Read our summary to learn more.

Payment Licenses in Europe: How To Find the Right Regulator?

Obtaining a banking/payment licence in one EU state generally entitles a financial organisation to trade in all the other states. Yet the approval process can vary greatly from one jurisdiction to another. Which one is best? How can you find the right jurisdiction?

PSD3 Overview: The Draft Has Pitfalls Lurking Amongst the Good Intentions

PSD3: A much anticipated payment regulation

How will the third incarnation of the EU Payment Services Directive affect PSPs and other fintech firms? Significantly so, if it passes in its current form.

Want to say hello or find out more? Contact us.

info@contextuals.de

www.contextualsolutions.de

Contextual Solutions

Berlin, Germany