Navigating the AI Frontier: The UK's Sandbox Strategy

UK Technology Secretary Liz Kendall (Yui Mok/PA)

On October 21, 2025, at the Times Tech Summit in London, UK Technology Secretary Liz Kendall unveiled the UK’s blueprint for AI regulation, centered on the creation of "AI Growth Labs" equipped with regulatory sandboxes. These controlled environments allow innovators to test AI applications in real-world settings by temporarily relaxing outdated rules, all under strict supervision. The initiative targets sectors like healthcare, housing, professional services, transport, and advanced manufacturing, aiming to accelerate AI adoption amid a stark reality: only 21% of UK firms currently utilize the technology, despite the OECD estimating it could boost productivity by 1.3 percentage points annually — equivalent to £140 billion in economic value.

For European fintechs, accustomed to navigating the EU's stringent AI Act, the UK approach offers a compelling model of agile, pro-innovation governance that could inspire cross-border strategies in digital finance, fraud detection, and automated lending.

“Startup Coalition has long campaigned for a cross-economy sandbox to help speed up startups’ route to market. The UK has historic strengths in sandboxing and this latest proposal takes it into the future helping bring regulators and businesses together to collaborate in a nimble and open way.

It is great to see government take a leaf out of the startup manual by adjusting their risk appetite to win the race.”

- Vinous Ali, Deputy Executive Director at Start-Up Coalition

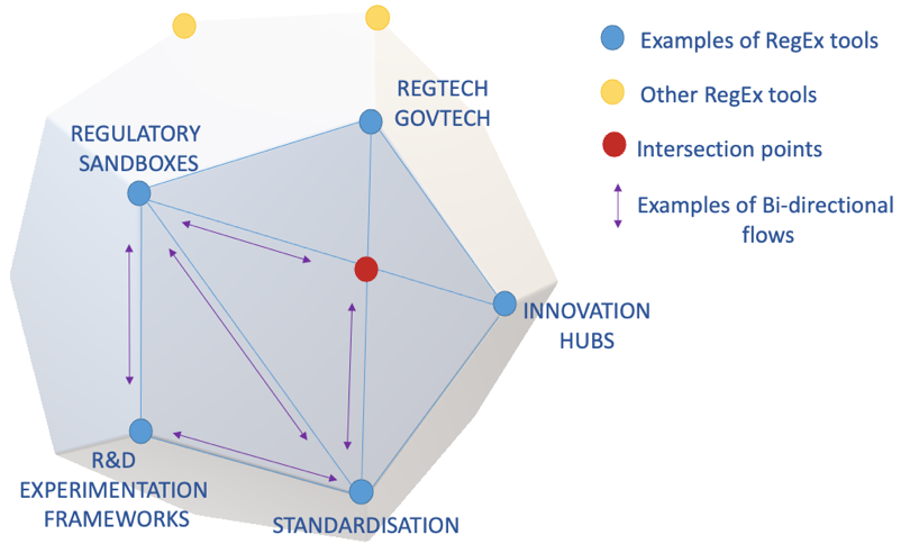

The blueprint's core innovation lies in its sandboxes: time-limited testing zones where regulations can be "switched off or tweaked" for specific AI pilots, excluding critical safeguards like consumer protection, fundamental rights, workers' protections, and intellectual property. Drawing from the UK's pioneering Financial Conduct Authority (FCA) fintech sandbox launched in 2016, which has influenced global models in Singapore, the US, and Estonia; this framework extends the concept to AI.

In fintech, where AI drives everything from algorithmic trading to personalized banking, such sandboxes could slash compliance timelines, enabling faster deployment of tools like real-time fraud analytics or predictive credit scoring.

“AI sandboxes test the fitness of AI regulations or services against existing AI standards. However, AI standards and AI regulatory sandboxes are at an early stage of development and need to inform each other.”

Kendall's announcement underscores the UK’s pragmatic optimism about the technology. She envisions these labs unlocking applications like AI-accelerated NHS diagnostics to cut waiting times or streamlined housing approvals via automated planning reviews. The government projects £6 billion in business savings by 2029 through reduced bureaucracy, positioning the UK as a global AI hub.

This initiative resonates deeply with European fintech leaders, who grapple with the EU AI Act's risk-based prohibitions on high-risk systems like biometric surveillance. While the Act, effective from August 2025, mandates transparency and human oversight for prohibited AI in finance, the UK's sandbox model offers flexibility absent in Brussels' more prescriptive regime. For EU-based executives eyeing PSD3's open finance mandates, the UK's approach signals opportunities for hybrid models: testing AI-driven payment APIs in sandboxes before EU-wide rollout, potentially reducing time-to-market by months.

“Accelerating AI adoption is critical for the UK banking sector and the entire economy. This initiative will give innovators like Revolut the clarity and speed we need to build and deploy groundbreaking AI services, reinforcing the UK’s leadership and delivering real value to millions of customers.”

Commentary from industry figures online has mostly been enthusiastic. The Department for Science, Innovation and Technology launched a public call for views, posting: "We want the UK to be the best place to test, scale and grow AI... Tell us what you think" about the sandboxes. This elicited responses from many ; for instance, Luther Lowe, Head of Public Policy at Y Combinator praise the approach for reducing entrepreneurial friction.

“The AI Growth Lab addresses a critical challenge: enabling AI startups to launch innovative products without waiting years for regulatory clarity.

For Y Combinator companies, faster time to market matters—and if the Lab delivers on its promise while maintaining appropriate oversight, it sets a strong model for how governments can keep pace with AI innovation.”

For regulators in other jurisdictions, the blueprint offers a few lessons. It exemplifies "pro-innovation" regulation, contrasting the EU's heavier hand and potentially harmonizing via the UK's post-Brexit flexibility. Fintechs could leverage sandboxes for PSD3-compliant AI tools, like open banking fraud detectors, while partnering with UK regulators for EU pilots. As Kendall put it, "Pragmatic and efficient rules for AI will help to turn UK start-ups into global leaders."

Ultimately, the UK's AI sandboxes represent a wager on responsible disruption. By blending experimentation with oversight, they could propel fintech innovation, from tokenized assets to AI-orchestrated compliance. As the wide-ranging commentary illustrates, the conversation is global and European executives must engage to shape it.

In a field racing toward autonomy, such frameworks remind us: innovation thrives in high-trust ecosystems, not in silos.

“The AI Growth Lab is an interesting and creative initiative to provide the flexible regulatory approach that will support faster UK AI innovation and we look forward to hearing more.”