A Glimpse Into the Future of Banking With Quantum Computing

As artificial intelligence (AI) continues to reform industries and processes as the number one tech infrastructure, quantum computing follows as the close second, thanks to its predictive powers.

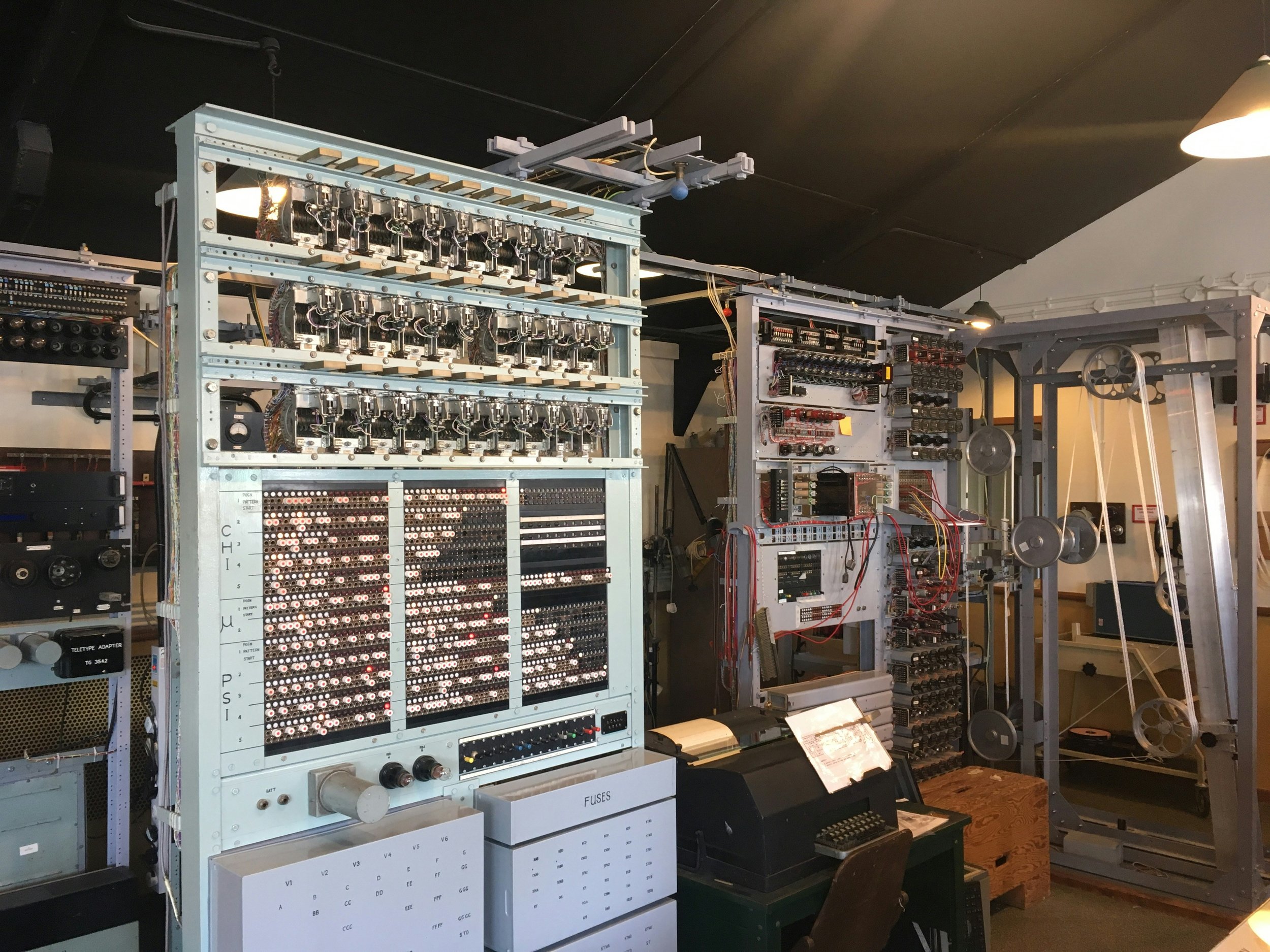

Photo by Farai Gandiya on Unsplash

Quantum computing, the computer science discipline based on quantum theory developments, uses the power of physics to tackle challenges too complex for standard computers. In the future, experts will use quantum computers to tackle compound problems, identify patterns, and create predictions.

No doubt, one sector that stands to benefit immensely from the potential of quantum computing is finance and banking. Board members and executives in these industries should prepare for a paradigm shift as quantum computing paves the way for unprecedented data processing, optimization, and security advancements.

Understanding Quantum Computing: A Quantum Leap in Processing Power

In short, quantum computing is a superior problem-solving method using advanced computer science, physics, and mathematics.

Traditional computers use bits as the fundamental unit of information, representing either a 0 or a 1, called the binary system. Quantum computers, on the other hand, leverage qubits, which can exist in multiple states simultaneously due to the principles of superposition and entanglement. This inherent capability allows quantum computers to process vast amounts of data at speeds unimaginable with classical computers.

Quantum computers already exist; however, they are not available in full glory and are commercially widespread.

Quantum Computing Use Cases in Finance

Quantum computing will likely enhance existing infrastructures rather than replace them. The technology is currently being tested by regulators and organizations such as BaFin and ECB to prepare for the future of finance and eliminate potential risks.

Most regulators see mainly IT-security-related risks in using quantum computing in banking and finance.

On the other hand, quantum computing’s potential use cases in finance include interesting advancements.

Optimizing Complex Financial Models

For board members and executives in finance, quantum computing brings with it the promise of accelerating complex computations involved in risk assessment, portfolio optimization, and algorithmic trading. Traditional models often struggle with the sheer volume of data involved in these processes, leading to compromises in precision and efficiency. Quantum computers, with their ability to explore multiple possibilities simultaneously, can unlock new dimensions of optimization, providing more accurate risk assessments and driving better investment decisions.

Breaking Cryptographic Barriers

The world of finance heavily relies on secure communication and data protection. Quantum computers have the potential to disrupt traditional cryptographic methods by efficiently solving complex mathematical problems that currently underpin encryption protocols. While this poses a challenge for existing security measures, it also opens the door for the development of quantum-resistant cryptographic algorithms. Board members should consider investing in quantum-safe encryption technologies to future-proof their financial infrastructure.

On the other hand, the defense of the current digital infrastructure from quantum computing-based attacks should be investigated.

Simulating Market Dynamics

Quantum computers excel at simulating complex systems, and this ability can be harnessed to model and understand market dynamics in ways previously thought impossible. Executives can leverage quantum simulations to explore various economic scenarios, assess the impact of policy changes, and gain deeper insights into market trends. This foresight can be invaluable for strategic decision-making, risk management, and staying ahead of the competition in the dynamic world of finance.

Realizing Quantum Advantage in Finance

Quantum computing is not just a futuristic concept; several companies are already making strides in this domain. IBM, Google, and Rigetti Computing are among the frontrunners in developing practical quantum solutions for various industries, including finance. Collaborating with these pioneers and investing in quantum-ready infrastructure can position financial institutions at the forefront of technological innovation.

Preparing for the Quantum Future

While quantum computing holds immense promise, it's essential for board members and executives to approach its integration with caution. Quantum computers are still in their infancy, and widespread adoption may take time. However, staying informed, investing in research and development, and fostering collaborations with quantum computing experts will prepare financial institutions to embrace the transformative potential of quantum computing when the time is ripe.

Quantum computing is poised to reshape the financial landscape within 20 years, offering unparalleled computational power, enhanced security solutions, and revolutionary insights into market dynamics. Board members and executives in finance should view quantum computing not as a distant possibility but as an imminent reality that demands strategic planning and proactive engagement. As the quantum era unfolds, those who embrace this cutting-edge technology will undoubtedly lead the way into a new era of financial innovation and success.